Your legacy. Your way.

The life you’ve built says a lot about you: Your values. The impact you’ve made. Your dreams for the future. A charitable gift can help you leave a legacy for the next generation – without affecting your present lifestyle or what you leave your family.

It’s not every day we ask ourselves, “What is my legacy?” But once in a while, perhaps after the passing of a close relative or longtime friend, we take a moment to step back and ask ourselves this important question.

When we are young and career-focused, our mind is often on learning and earning. It is often later in life when we focus more on returning. Through this returning, we gain the opportunity to create a legacy that will outlive us and benefit the world when we are gone.

It is true that your good work and good deeds live forever in the hearts and minds of those you impact along the way. In fact, those are the things that bring greater meaning and purpose to what you do every day. When we see our professional career as more than a money-focused endeavor, we begin to grasp how we can make a difference among colleagues, family and the world around us. This brings much greater satisfaction than social status or material possessions.

The reality is that you have no control over when you will pass, but you do have some control over how your assets will be handled after death and the legacy you leave.

When you think about leaving a legacy, there is generally one of three goals you likely want to accomplish:

- Passing on something of value to future generations;

- Leaving something of yourself for others to remember; and

- Creating memories of significance for your family.

Unfortunately, many people do not realize that, through the thoughtful planning of their estate, they have the potential to multiply those efforts after they are gone. This is what makes estate planning a step of such immediate importance in our lives. It gives you the choice, while you are still living, to determine the who, what, when, where and how of your estate.

It allows for substantial savings when dealing with taxes, court costs and attorneys’ fees. It also helps your family and friends avoid the burden and financial confusion that often occurs.

In many cases, it’s also possible to use some planning strategies to increase the size of the estate, while also benefiting the family members and charities you cared about during your lifetime. Admittedly, estate planning takes effort, time, courage and decision making. You can wait until tomorrow. But what if tomorrow does not come? There are many sound reasons for planning your estate today, and in doing so, you take a final shot at securing your legacy.

Make Pheasants Forever Calgary a beneficiary in your Will and know that your legacy will live on for generations. All it takes is a simple clause in your Will. In addition, a tax receipt for the full amount of your donation will be issued and may offset capital gains or other taxes payable to lessen the financial cost on your estate.

Choosing to leave a gift in your Will has significant benefits:

- Tax Relief – Depending on the type of asset, leaving a gift in your Will to Pheasants Forever Calgary can significantly reduce estate taxes.

- Flexibility – Your gift can be for any specific amount, percentage or residue of your estate.

- Peace of mind – You can make adjustments to your Will at any time.

- Cost-effective – There are no extra out-of-pocket costs. Your current income won’t be affected.

Note: This information is not intended to provide any financial, legal or tax-related advice. You are encouraged to seek independent professional advice from a qualified accountant, lawyer, or financial advisor to ensure proper planning and donation administration.

Follow these steps:

1. Talk to us – Call 1 403 995-9960 or email info@pfcalgary.ca.

2. Talk to your loved ones – This is an important discussion. Let them know your wishes and reassure them that you’re not choosing between family and Pheasants Forever Calgary.

3. Speak to your professional advisors – A call to the experts will get you started down the right path, with knowledgeable advice.

4. Update your Will – Decide if you want to leave a percentage or a specific amount of your estate to Pheasants Forever Calgary, and update your Will with the recommended wording from your professional advisor.

5. Let us know your decision – You’re under no obligation, of course, but letting us know that you’ve chosen to leave a gift to Pheasants Forever Calgary in your Will allows us to plan how to use those additional funds most effectively.

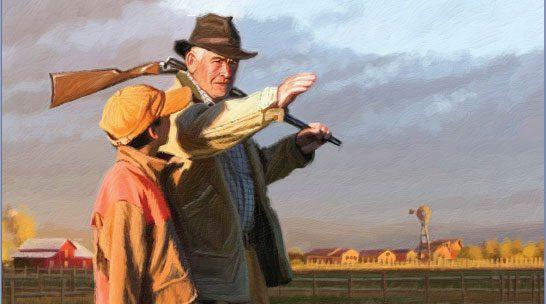

Illustration by Dan Burr (content provided by Pheasants Forever Inc.)